Here , Effectiveness refers to completing the job on time ,no matter whatever the cost. On the other hand, Efficiency refers to completing the job in the cost-effective manner.

Management not helpful in proper functioning of a business but it also helps in self-improvement.

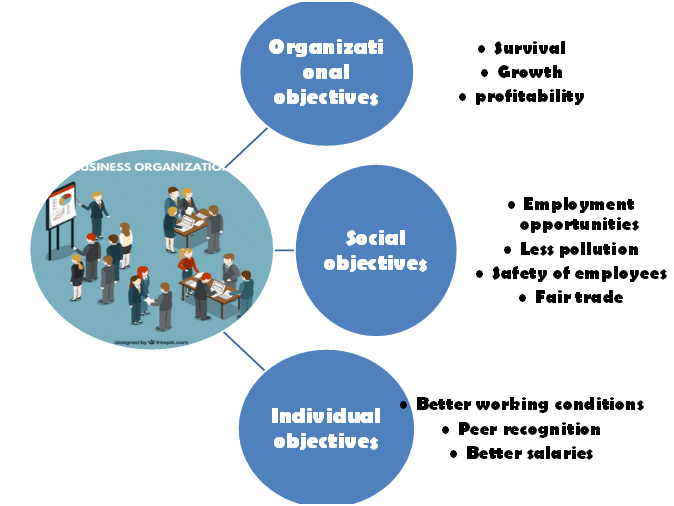

Management have certain objectives which we will achieve if we follow proper guidelines.....

• ORGANISATIONAL OBJECTIVES: It refers to the utilisation of human and physical resources available in the organisation,considering the interest of all the shareholders. Organisational economic objectives fulfils the survival , profit and growth objectives of the company.

• SOCIAL OBJECTIVES: It refers to the consideration of the interest of the society during managerial activities. An organisation run through the resources made available by the society. That is why it becomes the responsibility of every organisation to account for social benefits. Under this objective the manager Promises to assure health ,safety and price control.

The main objectives of the management are included in the the following list:

1. To make available employment opportunities.

2. To save environment from getting polluted.

3. To contribute in improving living standards.

• PERSONAL OBJECTIVES: It refers to the objectives to be determined with respect to the employees of the organisation. Every organisation is a group of people having different Nature. These people become a part of the organisation with a view to fulfil the following three needs.

1. Financial Needs: These people expect a competitive salary and other perk from the organisation.

2. Social Needs: These people want to get recognition from their peers.

3. Higher-level Need : these people want to get sufficient opportunities for personal development.

What is the importance management?

The importance of management is explained through the following facts:

✓ Management helps in Achieving Group Goal

✓ Management Increases Efficiency

✓Management Creates a Dynamic Organisation (Means helps to face changing environment)

✓Management helps in Achieving Personal Objectives

✓ Management helps in the Development of society

MANAGEMENT HAVE DIFFERENT LEVELS :

Top-level management : ( It includes "determining objectives", "determining Policies", "determining Activities", "Assembling Resources" and "Approving Budget".

MIDDLE-LEVEL MANAGEMENT : ( It includes "Interpreting policies", "Appointing Employees" ,"Assigning Necessary Duties" , "Motivating Employees" and "Creating Cooperation)

LOWER-LEVEL MANAGEMENT: ( It includes "overseeing efforts of actual workforce" , "Interaction with actual workforce" , "Ensuring qualiy and minimising wastage" )

Management involves

• planning

• Organising

• Staffing

• Directing

• Controlling

Coordination is the essence of the management for the achievement of harmony of individual efforts towards the accomplishment of group goals.....